nebraska inheritance tax rates

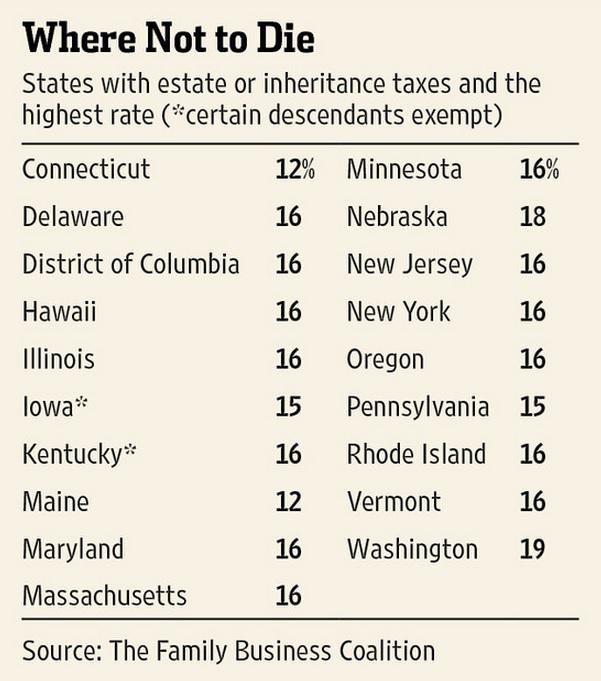

Nebraska collects a state corporate income tax at a maximum marginal tax rate of 7810 spread across two tax brackets. Nebraska currently has the nations top inheritance tax rate 18 on remote relatives and non-related heirs.

How Much Tax Do You Pay On Inheritance Legacy Design Strategies An Estate And Business Planning Law Firm

Inheritance tax rate cuts advanced by NE Legislature.

. 122 794 NW2d 406 2011. Close relatives pay 1 tax after 40000. According to a local law firm When a person dies a resident of Nebraska or with property located in Nebraska the Nebraska county inheritance tax will likely apply to the decedents property.

All Major Categories Covered. Ad Real Estate Landlord Tenant Estate Planning Power of Attorney Affidavits and More. Other Transfers All other beneficiaries receive a 10000 exemption and property valued over the exempt amount is subject to an 18 tax.

Nebraska tax tables - Nebraska state withholding 2022 Notification to Permitholders of Changes in Local Sales and Use Tax Rates Effective July 1 2022 Notification to Permitholders of Changes in Local Sales and. The tax rate would remain 1 percent. In re Estate of Craven 281 Neb.

Close relatives of the deceased person are given a 40000 exemption from the state inheritance tax. The burden of paying Nebraskas inheritance tax ultimately falls upon those who inherit the property not the estate. Select Popular Legal Forms Packages of Any Category.

Lawmakers gave first-round approval Jan. State inheritance taxes are not imposed on the deceaseds family members who will get an exemption of 4000. Here is an example.

In other words they dont owe any tax at all unless they inherit more than 40000. Nebraska inheritance tax is computed on the fair market. Life EstateRemainder Interest Tables REG-17-001 Scope Application and Valuations 00101 Nebraska inheritance tax applies to bequests devises or transfers of property or any other interest in trust or otherwise having characteristics of annuities life estates terms for years remainders or reversionary interests.

Clear market value is measured by the fair market value of the property as of the date of the death of the grantor less the consideration paid for the property. Of the six states that currently impose inheritance taxes only two states Nebraska and Pennsylvania have chosen to tax lineal heirs children and grandchildren while the others exempt these relatives. An inheritance by the widower of a daughter is not taxable at the rate prescribed by this section.

The average salary for a IT Administrator in Nebraska is 62000 per year. Beneficiaries inheriting property pay an inheritance tax over the value that exceeds their exemption amount which ranges between 10000 and 40000. There are only six states in the nation that levy an inheritance tax and Nebraska is one of them.

First you take out the exemption of 1206 million leaving a taxable estate of 782 million. Bill to cut inheritance tax rates increase exemptions advanced. 5 rows Nebraska Inheritance Tax.

Nebraska inheritance tax rates If you were the decedents parent grandparent sibling child other lineal descendant or the spouse of one of those people the first 40000 you inherit is exempt but the value of your inheritance above 40000 is taxed at 1. Nebraska Income Tax Rates for 2022 They advanced a tax. All they have to do is inherit more than 40000.

The tax has a series of ascending tax rates with a top rate of 40. That exemption amount and the underlying inheritance tax rate varies based on the inheritance. Instead Nebraska has an inheritance tax that is imposed on the person who receives property at the death of a Nebraska resident or receives Nebraska real estate at the death of a non-resident.

Inheritance Tax Rates by State Ranked by Bracket ChildRateNephewNiece Non-RelativeRate Rate 1. Nebraska does not have an estate tax that is levied on the size of a persons estate at death. If they inherit more than 40000 a 1 tax will apply to the amount over the first 40000.

Tax Rates and Exemptions. In fact Nebraska has the highest top rate at 18. 11 to a bill that would cut Nebraskas inheritance tax rates while increasing the amount of property value that is exempt from the tax.

If the decedents property passes to his or her parents grandparents siblings children or any lineal decedents or the spouse of any such person so called Class 1 beneficiaries the inheritance tax is imposed on the value of property in excess of 40000 at a rate of 1 percent. There are a total of eighteen states with higher marginal corporate income tax rates then Nebraska. They are liable for no taxation at all.

Will have to pay 1 of the original 40000 if. As introduced by Elmwood Sen. The inheritance tax must be paid within 12 months of the date of death otherwise interest accrues at 14 with penalties of 5 per month up to 25 of the tax due.

Say your estate is worth 1988 million and you are not married. The exemption for more distant relatives would increase to 40000 and the rate would drop to 11 while the exemption for unrelated heirs would increase to 25000 and the rate would drop to 15. 2022 Federal Personal Income Tax Tables Average Sales Tax With Local.

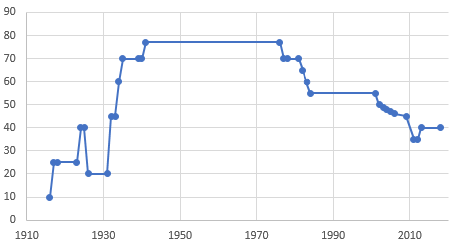

37 rows LB310 - Change inheritance tax rates inheritance tax exemption amounts and individuals who are considered relatives of a decedent. For states to immediately amend their inheritance tax laws into progressive structures and many states that had not yet levied the tax added it to their tax rolls. Robert Clements last session LB310 would have cut rates in half over three years.

Until this TABLE 1. State inheritance tax rates. This table lists each changed tax jurisdiction the amount of the change and the towns and cities in which the modified tax rates apply.

This class receives a 15000 exemption and property valued over the exemption is subject to a 13 tax. The amendment also would decrease the rate from 13 to 11 percent for remote relatives and increase the exemption from amounts more than 15000 to amounts over 40000. Nebraska Inheritance Tax Summary.

Before the official 2022 Georgia income tax rates are released provisional 2022 tax rates are based on Georgias 2021 income tax brackets. A third rate currently 18 percent of the clear market value of beneficial interests over 10000 applies in all other cases.

Twelve States And Washington D C Impose Estate Taxes And Six States Impose Inheritance Taxes Maryland Is The Estate Tax Inheritance Tax Arizona Real Estate

Do I Need To Pay Inheritance Taxes Postic Bates P C

The Death Tax Taxes On Death American Legislative Exchange Council

How Much Is Inheritance Tax Community Tax

States With No Estate Tax Or Inheritance Tax Plan Where You Die

What Is Inheritance Tax And How Much Is It

Estate Tax In The United States Wikiwand

States With Inheritance Tax Or Estate Tax Bookkeepers Com

States Where Residents Are Most Satisfied Estate Tax Inheritance Tax Nightlife Travel

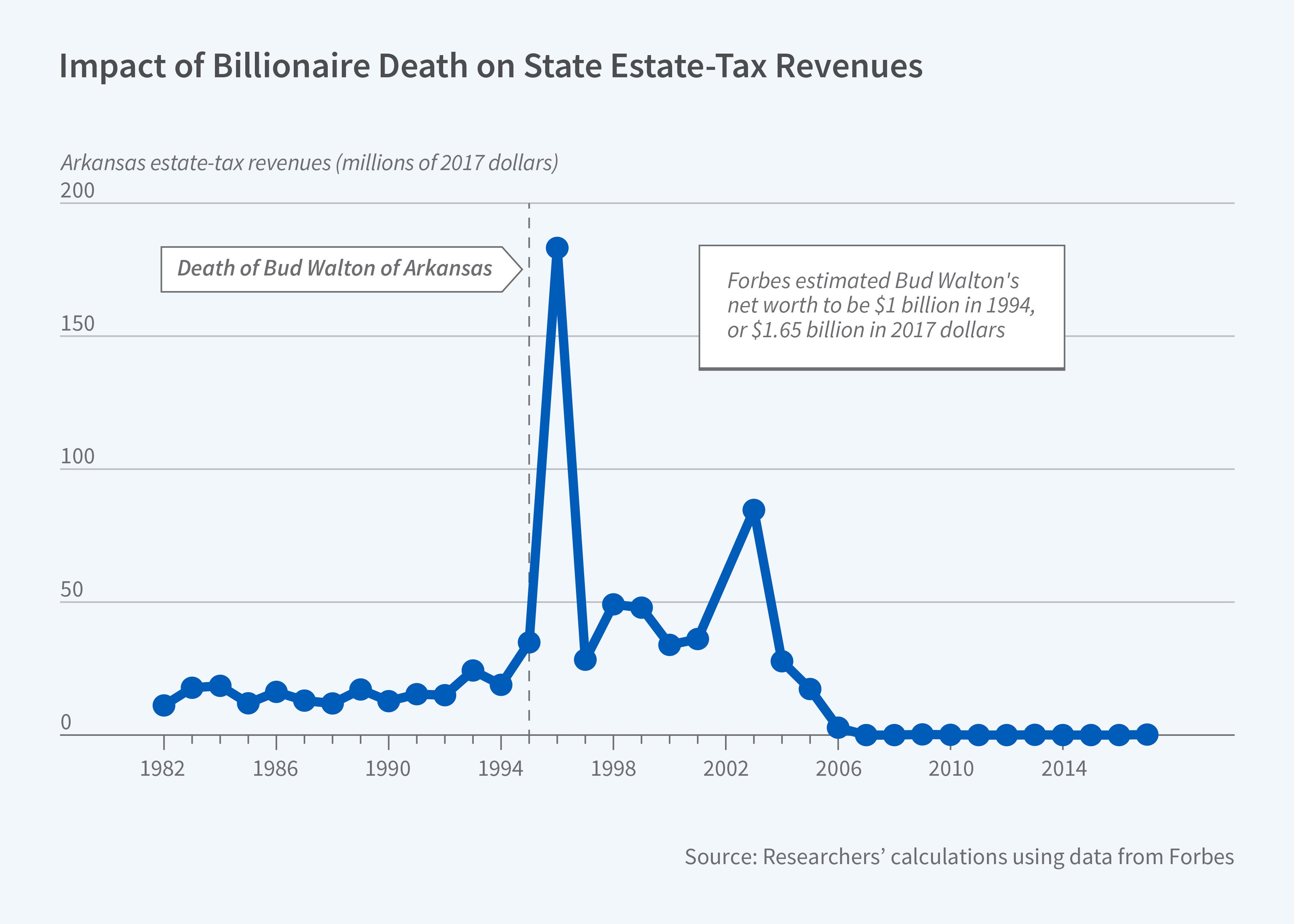

State Level Estate Taxes Spur Some Billionaires To Move Nber

How Much Is Inheritance Tax Community Tax

How Do State Estate And Inheritance Taxes Work Tax Policy Center

Inheritance Tax 2022 Casaplorer

Iowa S Repeal To Leave Nebraska With Region S Only Inheritance Tax

Eight Things You Need To Know About The Death Tax Before You Die

Estate Tax In The United States Wikiwand